Our Frost Pllc Statements

Table of ContentsSome Known Details About Frost Pllc The 20-Second Trick For Frost PllcThe Frost Pllc PDFsGetting The Frost Pllc To WorkThe Main Principles Of Frost Pllc The 2-Minute Rule for Frost Pllc

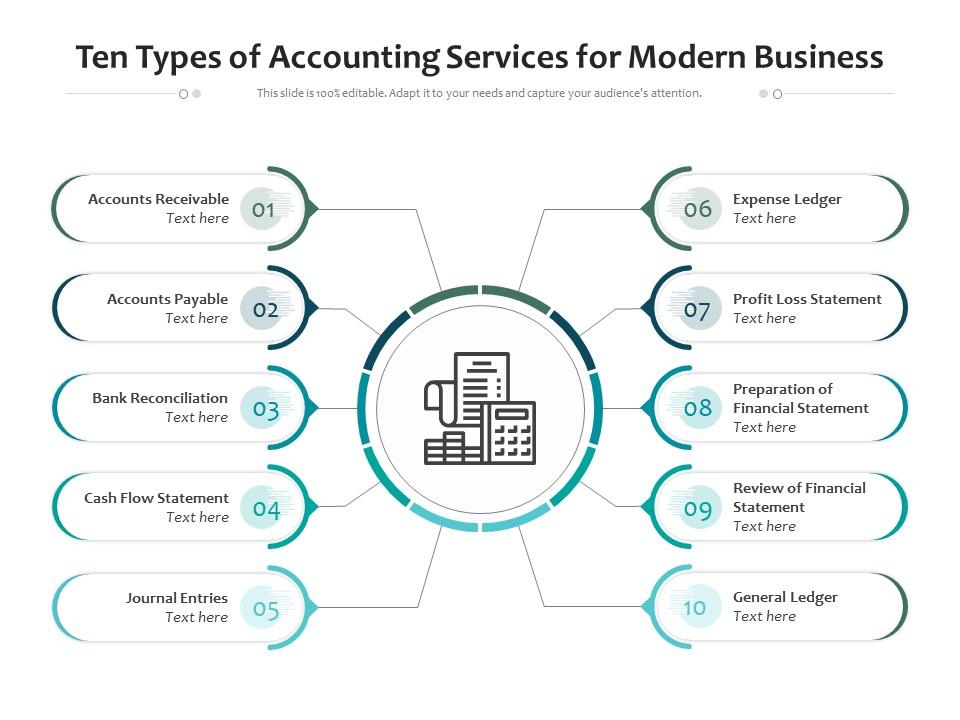

A skilled and determined certified public accountant can dedicate to a long-term management accountancy duty. As your company expands, the certified public accountant concentrating on administration accounting can offer terrific help. Bear in mind that management audit has a tendency to be costly, depending upon the dimension of your service. If you wish to conserve money however don't intend to lower the advantages of monitoring accountancy, be prepared to seek a certified public accountant that wants to use an adaptable deal.This will certainly ensure that all sources of business data are reputable. And also, you will be able to see the full weight of the believed fraudulence. Key Jobs for Forensic Accountants: Fraud Investigation, Monitoring of Missing Funds, Financial Inconsistency Analysis Technically, monitoring consulting is a self-control that's in some way different from basic accountancy services.

Frost Pllc - Questions

Secret Jobs for Bookkeeping Auditors: Financial Testimonial, Financial Auditing Establish Your Organization Goals & Priorities Goal-setting is a vital part of a little company trip. The very same point applies to browsing for audit solutions.

From that factor on, the CPA can recommend the ideal accountancy service for your service. Know Your Financial Scenario One of the primary responsibilities of a service owner is to comprehend the economic circumstance of his or her organization.

CPAs can always deal with numerous types of economic accountancy services. Simply explain your financial scenario and a great CPA will certainly propose the appropriate solution.

The finest method to safeguard the solutions of a CPA is to get to out to an accounting firm. Considering that there are hundreds of accountancy companies operating in the United States, it can be difficult to make an option.

Getting My Frost Pllc To Work

The audit company must be friendly, thoughtful, and client-oriented. As soon as you have actually taken care of to discover a professional accounting firm, stick to it.

Integrity A trustworthy audit firm can assist your company in several possible layers. Integrity is a crucial attribute that will certainly determine a firm's effectiveness in every feasible audit location. If a bookkeeping firm is reputable in all elements, you find this can ask for different kinds of solutions. Highly likely, a CPA from that company is also reliable sufficient.

You can additionally determine a CPA's reputation by the means he or she suggests a crucial solution for your company. Honesty Unquestionably, honesty is one of the hardest characteristics to gauge. In the beginning look, there's no accurate way to determine if a certified public accountant company has a deep feeling of integrity.

Technology & Creativity Advancement is an impressive attribute that can measure the skills of a bookkeeping firm. If the firm is ingenious, after that it can use contemporary solutions to your bookkeeping troubles. On the various other hand, a cutting-edge certified public accountant will have fresh ideas that can assist your organization. Just like innovation, imagination can go a long way.

Not known Facts About Frost Pllc

Choosing a bookkeeping solution for your organization is a wise yet delicate step. Make sure that you're prepared before getting to out to an accounting company.

Audit history goes back to ancient worlds in Mesopotamia, Egypt, and Babylon. Frost PLLC. As an example, throughout the Roman Empire, the federal government had described records of its financial resources. Modern audit as a career has just been around considering that the very early 19th century. Luca Pacioli is considered "The Dad of Bookkeeping and Bookkeeping" because of his payments to the growth of accounting as check my reference an occupation.

The ARPL is a coalition of numerous innovative expert teams consisting of engineers, accounting professionals, and engineers. Accountants may be charged with recording certain deals or functioning with particular sets of details.

The economic declarations of a lot of companies are audited every year by an external CPA company. Most business will have annual audits for one factor or one more.

The Definitive Guide for Frost Pllc

Basically, cost accountancy considers all of the expenses connected to producing a product. Experts, managers, entrepreneur, and accountants use this details my response to determine what their products ought to cost. In expense accounting, money is cast as an economic consider production, whereas in financial audit, money is taken into consideration to be a step of a firm's economic performance.

These policies are evaluated the federal, state, or neighborhood degree based upon what return is being submitted. Tax obligation accounts equilibrium conformity with reporting policies while likewise attempting to lessen a firm's tax responsibility with thoughtful critical decision-making. A tax obligation accountant frequently supervises the entire tax obligation process of a business: the critical development of the company graph, the operations, the compliance, the reporting, and the remittance of tax liability.

In copyright, the three heritage designationsthe Chartered Accountant (CA), Qualified General Accounting Professional (CGA), and Licensed Monitoring Accountant (CMA)have been unified under the Chartered Specialist Accounting Professional (CPA) classification. A significant component of the accountancy occupation is the "Big Four". These 4 largest accounting companies (Ernst & Youthful, KPMG, PricewaterhouseCoopers, Deloitte) conduct audit, consulting, tax advising, and various other solutions.

Keeps the system and software program in which audit documents are processed and kept. Oversees the accountancy functions of economic reporting, accounts payable, accounts receivable, and procurement. (GAAP) when preparing financial declarations in the United state

Its standards are based on double-entry accounting, bookkeeping method in which every accounting transaction accountancy deal as gotten in a debit and credit in two separate 2 ledger accounts that will roll up into the balance sheet equilibrium income statement.